SECURITIES AND EXCHANGE COMMISSION

the Securities Exchange Act of 1934 (Amendment No. )

![[MISSING IMAGE: lg_simfoodscomp-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/lg_simfoodscomp-pn.jpg)

![[MISSING IMAGE: lg_simfoodscomp-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/lg_simfoodscomp-pn.jpg)

| | ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg) | |

![[MISSING IMAGE: ic_when-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_when-pn.jpg) | ||||||||||||||

| When Thursday, January 18, 2024, at 9:00 a.m. (ET) | | | ![[MISSING IMAGE: ic_where-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_where-pn.jpg) | | | Where (Virtual Format Only) virtualshareholdermeeting.com/SMPL2024 | | | ![[MISSING IMAGE: ic_who-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_who-pn.jpg) | | | Who Stockholders as of the | |

| ||||||||||||||

| ||||

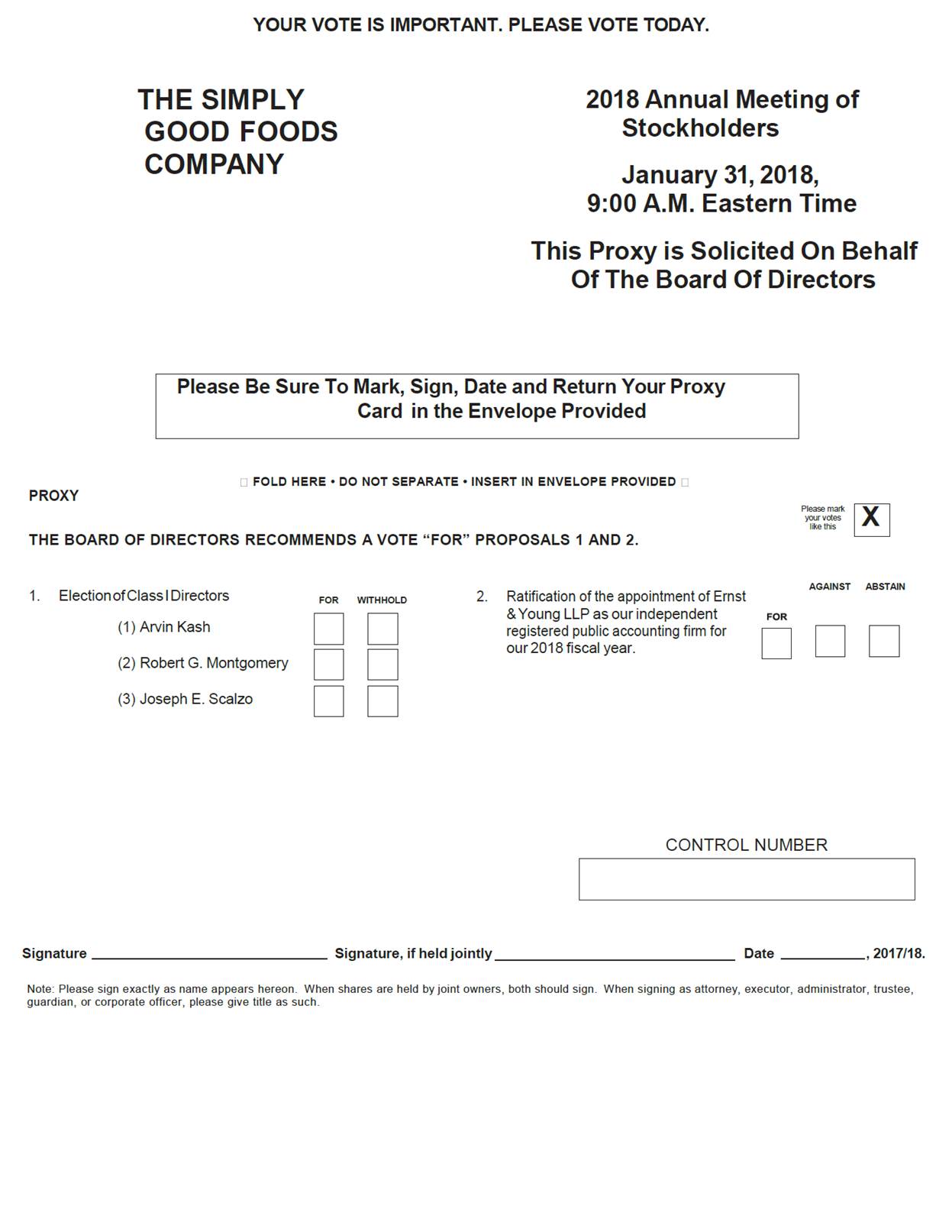

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

December 21, 2017

Dear Fellow Stockholders,

1.To elect the three Class I director nominees;2.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our 2018 fiscal year; and3.To transact such other business as may properly come before theheld entirely online via audio webcast, with no physical in-person meeting.

We know of no other matters If you plan to come beforeparticipate in the Annual Meeting. Only stockholdersMeeting, please see the “General Information About the Annual Meeting and Voting” section in the attached proxy statement. Stockholders will be able to participate in, vote and submit questions from any location via the internet by visiting

| | Items of Business | | | Board Recommendation | |

| | Proposal 1 | | | FOR EACH NOMINEE | |

| | Election of the 12 director nominees | | |||

| | Proposal 2 | | | FOR | |

| | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2024 | | |||

| | Proposal 3 | | | FOR | |

| | Adoption of the Fourth Amended and Restated Certificate of Incorporation of The Simply Good Foods Company in the form attached as Annex II to the accompanying proxy statement | | |||

| | Proposal 4 | | | FOR | |

| | Advisory vote to approve the compensation of our named executive officers | | |||

![[MISSING IMAGE: sg_jamesmkilts-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/sg_jamesmkilts-bw.jpg)

December 7, 2023

| | ![[MISSING IMAGE: ic_phone-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_phone-pn.jpg) | | | BY PHONE: Call 1-800-690-6903, and follow the instructions on the proxy card | |

| | ![[MISSING IMAGE: ic_intern-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_intern-pn.jpg) | | | BY INTERNET: Before the Annual Meeting: proxyvote.com During the Annual Meeting: virtualshareholdermeeting.com/SMPL2024 | |

| | ![[MISSING IMAGE: ic_mail-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_mail-pn.jpg) | | | BY MAIL: If you received your proxy materials by mail, you can vote by mail by signing, dating and mailing the enclosed proxy card. | |

Your vote is important. Please note that if you hold your shares through a broker, your broker cannot vote your shares on the election of directors in the absence of your specific instructions as to how to vote. In order for your vote to be counted, please make sure that you submit your vote to your broker.

We appreciate the confidence you have placed in us through your investment in us, and we look forward to seeing you atduring the Annual Meeting.

| | ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg) | |

| ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALSFOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 31, 2018

Our Proxy Statement and Annual Report to Stockholders for the fiscalyear ended August 26, 2017 are available atwww.thesimplygoodfoodscompany.com/proxy.

PROXY STATEMENT SUMMARY TABLE OF CONTENTS are independent the Board of Directors (the “Board”) is independent Committees are independent stockholders Directors and Corporate Governance Officer to develop and gain approval from the Board of Committees; New Board Member Orientation We conduct an orientation program for new directors as soon as practical following their joining the Board. This orientation includes presentations and written information to familiarize new directors with our corporate governance, strategic plans, financial reporting, principal officers, auditing processes, risk assessment and such other topics as the Board and/or the Chief Executive Officer feel are appropriate. In determining whether to approve a related party transaction, the Audit Committee must consider For more information about our related party transactions, see “Certain Relationships and Related Party Transactions,” below. Process for Recommending or Nominating Potential Director Candidates Board. information relating to the candidate that would be required to be disclosed in a proxy statement or other similar filing to Conduct After consultation with Mercer (US) Inc. (“Mercer”), the Compensation Committee’s independent compensation consultant, the Board approved a director compensation program in line with competitive non-employee director compensation levels of our peer companies. Effective for fiscal year 2023, our director compensation program consisted of the following: Atkins directors(1) Ezra Field Richard Laube David Lee Steve Heyer Steve Powell Tom McNeely Michael Thompson Patti Larchet Simply Good Foods directors(2) James M. Kilts David J. West James E. Healey Clayton C. Daley, Jr Nomi P. Ghez Brian K. Ratzan Robert G. Montgomery Richard T. Laube Arvin Kash Our Board Committee, subject to the Investor Rights Agreement. Joseph J. Schena (Chair)* Nomi P. Ghez Robert G. Montgomery Payments Upon Termination or Change in Control — Executive Severance Plan,” below, with respect to vesting upon a Change in Control with Termination. Audit Fees(1) Audit-Related Fees(2) Tax Fees(3) All Other Fees Total Joseph Scalzo Shaun Mara Scott Parker Joseph Scalzo(1) Shaun Mara Scott Parker Joseph Scalzo President and Chief Executive Officer Shaun Mara Former Chief Administrative Officer and Chief Financial Officer(4) Scott Parker Chief Marketing Officer Joseph Scalzo Shaun Mara Scott Parker Joseph Scalzo Shaun Mara Scott Parker Equity compensation plans approved by stockholders Equity compensation plans not approved by stockholders Total equity compensation plans 22, 2023. 5% Stockholders: Conyers Park Sponsor LLC(2) Atkins Holdings LLC(3) T. Rowe Price Associates, Inc.(4) FMR LLC(5) Wellington Management Group LLP(6) The Baupost Group, L.L.C.(7) Directors and Executive Officers: James M. Kilts(2) David J. West(2) Brian K. Ratzan(2) Clayton C. Daley Jr. Nomi P. Ghez James E. Healey Robert G. Montgomery Arvin "Rick" Kash Richard T. Laube Joseph E. Scalzo Todd Cunfer C. Scott Parker All directors and executive officers as a group (15 individuals) Capital World Investors is 333 South Hope Street, 55th Floor, Los Angeles, CA 90071. Of the total number of shares listed above, such person has sole power to vote or direct to vote 6,134,300 shares, has shared power to vote or direct to vote 0 shares, has sole power to dispose of or to direct the disposition of 6,134,300 shares and has shared power to dispose or to direct the disposition of 0 shares. On July 7, 2017, in connection with the consummation of the Business Combination, Brian Ratzan individually. In connection with this distribution, we were informed that Conyers Park Sponsor assigned in whole to Messrs. Kilts, West and Ratzan, collectively, its rights to designate persons to be nominated for election to our Board under and in accordance with the Simply Good Foods their discretion. ��� 80202. We also have retained Morrow Sodali LLC, 333 Ludlow St., 5th Floor, South Tower, Stamford, Connecticut 06902, to assist in the solicitation of proxies for an estimated fee of $12,500, plus reimbursement of reasonable expenses. proxy in accordance with the recommendation of our management on such matters, including any matters dealing with the conduct of the Annual Meeting.

PageiiiINFORMATION ABOUT THE SIMPLY GOOD FOODS COMPANY 1GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING1Information About Attending the Annual Meeting 1 Information About this Proxy Statement 1BOARD OF DIRECTORS AND CORPORATE GOVERNANCEInformation About Voting 2Quorum Requirement3Required Votes for Action to be Taken3Other Business to be Considered4CORPORATE GOVERNANCE5Board of Directors5Director Independence5Board Leadership Structure5Annual Evaluations of the Board and Board Committees6Review of Related Person Transactions6Role of the Board of Directors in Risk Oversight7Communications with the Board of Directors7Process for Recommending or Nominating Potential Director Candidates8Succession Planning and Management Development 9 Code of Ethics 9 Availability of Committee Charters 10DIRECTOR COMPENSATION11Director Compensation11Director Stock Ownership Guidelines12MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS13Review of Risk in our Compensation Programs14Independent Compensation Consultant14PROPOSAL ONE: ELECTION OF DIRECTORS15Class I Directors Standing for Re-Election 15Directors Continuing in Office16PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR 2018 FISCAL YEAR20Audit Fees20Pre-Approval Policies and Procedures 21 EXECUTIVE OFFICERS 35 COMPENSATION DISCUSSION AND ANALYSIS 38 Executive Summary 38 AUDIT COMPENSATION COMMITTEE REPORT 51 COMPENSATION TABLES 22 MANAGEMENT 23Equity Compensation Plan Information 65 EXECUTIVE COMPENSATION 25Delinquent Section 16(a) Reports 65 Introduction 25Employment Agreements25Base Salary26iii

PROXY STATEMENT SUMMARYThe Simply Good Foods Company ("Simply Good Foods," the "Company," "we," "us" or "our") provides below ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

![[MISSING IMAGE: ic_vision-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_vision-pn.jpg)

Lead the nutritious snacking movement with trusted brands that offer a variety of convenient, innovative, great-tasting, better-for-you snacks, meal replacements and other product offerings. ![[MISSING IMAGE: ic_miss-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_miss-pn.jpg)

Empower healthy lives through smart and satisfying nutrition. ![[MISSING IMAGE: ic_value-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_value-pn.jpg)

Our Values of certain information contained elsewhere in this Proxy Statement.proxy statement. This is only a summary, so please refer to the full Proxy Statement and the Annual Report to Stockholders for the fiscal year ended August 26, 20172023, before you vote. Our latest Annual Report on Form 10-K along with this proxy statement are available at www.thesimplygoodfoodscompany.com/proxy. Our proxy materials will first be made available to stockholders on or about December 7, 2023. ![[MISSING IMAGE: lg_atkins-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/lg_atkins-bw.jpg)

Grounded by science and more than 100 clinical studies, the Atkins low carb lifestyle has helped millions of people achieve their personal weight management and health goals. Our portfolio of products includes protein bars, ready-to-drink shakes, chips, cookies, confectionary treats and frozen meals to support a low carb/low sugar lifestyle, with 100% free access to all tools including our website, 1600+ recipes, meal planner, mobile app, community forums, and more. ![[MISSING IMAGE: lg_questnut-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/lg_questnut-bw.jpg)

Date Quest is a brand of tempting, high protein, low carb anytime-foods that provide serious, “Athlete-Worthy” energy-promoting nutrition for all who want their personal quest for better health to be a fun and Time:Wednesday, January 31, 2018, at 9:00 a.m. (ET)rewarding experience. Quest offers a diverse array of protein bars, shakes, cookies, chips, crackers and confections that are all rooted in the core principles of great taste, while minimizing net carbs and sugar. Place:The Ritz-Carlton, 280 Vanderbilt Beach Road, Naples, FL 34108 $1,242.7M $133.6M $245.6M Record Date:December 4, 2017

net sales

net income Adjusted EBITDA $1.32 $1.63 $171.1M 0.8x diluted Earnings Per

Share Adjusted Diluted Earnings Per Share cash flow from operations Net Debt to Adjusted

EBITDA Ratio ![[MISSING IMAGE: ic_cash-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cash-pn.jpg)

Strong Cash Generation Our asset-light, outsourced manufacturing business model continues to be a competitive advantage. In fiscal year 2023, we generated steady cash flow from operations of $171.1 million. During the year, we paid down $121.5 million of our term loan debt, and at the end of fiscal year 2023 the outstanding principal balance was $285 million, we had cash and cash equivalents of $87.7 million, and our trailing 12-month Net Debt to Adjusted EBITDA ratio was 0.8x*. ![[MISSING IMAGE: ic_ecomer-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_ecomer-pn.jpg)

Increasing Market Performance in Attractive Nutritional Snacking Category Our total Simply Good Foods market performance within the total nutritional snacking category, in the combined measured and unmeasured channels, increased 13%. This is based on IRI Multi-outlet plus Convenience Stores (IRI-MULO+C store) retail takeaway data for measured channels and our internal data for unmeasured channels. Quest and Atkins continue to be leaders in their respective subsegments of active nutrition and weight management with top tier performance versus competitor brands. Specifically, Quest fiscal year 2023 retail takeaway in measured and unmeasured channels grew about 24% compared to fiscal year 2022. Atkins total retail takeaway in measured and unmeasured channels was up about 1% in fiscal year 2023 despite contraction in the weight loss subsegment of the category. We believe the long-term growth outlook for the nutritional snacking category is strong. We also believe current low household penetration coupled with consumer interest in snacking and wellness, provide tailwinds for future growth. ![[MISSING IMAGE: ic_supply-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_supply-pn.jpg)

Supply Chain Excellence Our supply chain team performed well and customer service levels improved during fiscal year 2023. Our team’s collaborative work with suppliers, contract manufacturers and distributors enabled us to service our retail and e-commerce customers at expected levels. ![[MISSING IMAGE: ic_nutrit-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_nutrit-pn.jpg)

Robust Innovation A portion of our sales is driven by new products, and we believe innovation is, and will continue to be, an important component of our business. In fiscal year 2023, we continued to build a robust pipeline of innovation across both of our brands. These new products are now available, or will be available in fiscal year 2024, and we believe these new products position us for continued market share gains in fiscal year 2024 and beyond. We believe the diversification of our business across brands, product forms and retail channels provides us with multiple ways to win in the marketplace. VOTING MATTERS AND BOARD RECOMMENDATIONS![[MISSING IMAGE: pc_ceo-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/pc_ceo-pn.jpg)

ProposalVote Required for ApprovalAbstentionsBrokerUninstructedShares (BrokerNon-Votes)Board'sRecommendationElection of the three Class I director nomineesA plurality of the votes cast (the three nominees receiving the highest number of "FOR" votes cast will be elected)No ImpactNo ImpactFOR all director nomineesRatification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our 2018 fiscal yearMajority of shares castNo ImpactVoted in broker's discretion FORPolicies Reflect Best Practices INDEPENDENCE OVERSIGHT &

ACCOUNTABILITY COMPENSATION

CONTROLS All independentexcept CEO SeparationChairman and CEO roles independent members of the Compensation, Committee, Audit CommitteeCorporate Responsibility and Sustainability and Nominating and Corporate Governance CommitteeDirector and executive officer stock ownership guidelines Third partyinvestors100% director attendance at Board and committee meetings during 2017• ![[MISSING IMAGE: pc_snap-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/pc_snap-pn.jpg)

Director Name

Principal Occupation Independent Other

Current

Public

Boards Audit Compensation Corporate

Responsibility

and

Sustainability Nominating

and

Corporate

Governance Directors standing for re-election at the Annual Meeting:

Age: 72

Director Since: 2017 ● 0 M C

Age: 77

Director Since: 2017 ● 0 M C

Age: 65

Director Since: 2019 ● 0 M C M

Age: 75

Director Since: 2017 ● 2 M

Age: 70

Director Since: 2017 ● 0 M M

Age: 53

Director Since: 2017 ● 1 M

Age: 57

Director Since: 2019 ● 0 M

Age: 65

Director Since: 2017 2

Age: 65

Director Since: 2021 ● 0 C

Age: 50

Director since 2023 0

Age: 60

Director Since: 2017 ● 2 M

Age: 63

Director Since: 2019 ● 3 M M iii See "Corporate Governance" in the for more details regarding our corporate governance practices.companyCompany throughout the fiscal year. WHO WE CONTACTED HOW WE ENGAGED TOPICS ![[MISSING IMAGE: ic_whowe-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_whowe-pn.jpg)

We participate in various investor conferences throughout the year, such as the Stephens Inc. Annual Investment Conference, the Goldman Sachs Global Staples Forum and the Stifel Nicolaus 2023 Cross Sector Insight Conference. In addition, from time to time, primarily after our quarterly earnings press release has been issued, our management participates in various investor meetings either scheduled by us or coordinated by various analysts. ![[MISSING IMAGE: ic_whowe-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_whowe-pn.jpg)

![[MISSING IMAGE: pc_sayonpay-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/pc_sayonpay-pn.jpg)

At our annual meeting of stockholders in January 2023, we held our annual advisory vote to approve the compensation of our named executive officers. The fiscal year 2022 compensation of our named executive officers reported in our 2023 proxy statement was approved by 99.3% of the votes cast at the 2023 annual meeting of stockholders. Our Compensation Committee believes this affirms our stockholders’ support of our approach to executive compensation, and, as a result, the Compensation Committee did not make any significant changes to our executive compensation program for fiscal year 2023. as well as participate2023, we published our first Impact Report, which is available publicly and which we intend to update annually.investor day conferences throughout the year, such as the CAGNY (Consumer Analyst Groupbusiness priorities, including key ESG initiatives. ![[MISSING IMAGE: ic_health-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_health-pn.jpg)

Health & Safety / Reporting Our focus is on providing safe and healthy working environments for all employees and consultants. Our employees are encouraged to take proactive measures toward accident prevention and safety. Employees have the right to refuse and report any unsafe or unhealthy working conditions. We aim to meet or exceed applicable laws and industry standards regarding safe and healthy working conditions. ![[MISSING IMAGE: ic_human-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_human-pn.jpg)

Human Rights & Employment Practices Simply Good Foods supports a diverse and inclusive workforce. We aim to treat employees with respect and dignity, and to promote a work environment that is free of discrimination, harassment, forced labor or abuse of any kind. ![[MISSING IMAGE: ic_envir-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_envir-pn.jpg)

Environmental Matters At Simply Good Foods, one of our goals is to work to reduce the adverse environmental effects from our operations. In addition to complying with all applicable environmental laws, we aim to continually improve upon our environmental performance and to conduct our operations in a way that reduces adverse effects on the environment, particularly regarding water usage, energy usage, emissions and solid waste. ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

New York) conferences.iv

1050 17th Street, Suite 1500Denver, Colorado 80265(303) 633-2840PROXY STATEMENTINFORMATION ABOUT THE SIMPLY GOOD FOODS COMPANYa growing developer, marketerdedicated to our goal of creating long-term stockholder value. It is our policy to conduct our business with integrity and sellerwith an unrelenting passion for providing value to our customers and consumers. All our corporate governance materials, including our code of branded nutritional foodsconduct, our corporate governance guidelines, and snacking products. Our highly-focused product portfolio consists primarily of nutrition bars, ready-to-drink shakes, snacksthe charters adopted by the Audit, Compensation, Corporate Responsibility and confectionery products marketedSustainability and Nominating and Corporate Governance Committees, are published under the Atkins®, SimplyProtein®, Atkins Harvest Trail, and Atkins Endulge® brand names. Our corporate“Corporate Governance” section within the “Investors” portion of our website is located atwww.thesimplygoodfoodscompany.com. www.thesimplyfoodgoodscompany.com. Information contained on our website does not constitute part of this proxy statement. Our Board regularly reviews these materials, Delaware law, Nasdaq listing standards and is not incorporatedSEC rules and regulations, as well as best practices suggested by reference in, this Proxy Statement. recognized governance authorities, and modifies our corporate governance materials as it deems warranted.("(“Conyers Park"Park”) and NCP-ATK Holdings, Inc. ("Atkins"(“Holdings”), which occurred on July 7, 2017 (the "Business Combination"“Business Combination”). As a result of the Business Combination, Simply Good Foods owns all the equity interests of Holdings. Certain aspects of our corporate governance, described in more detail below, were established as part of the equity in Atkins.GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING Information About Attending the Annual Meeting Our Annual Meeting will be held on Wednesday, January 31, 2018, at 9:00 a.m. (ET), at The Ritz-Carlton, 280 Vanderbilt Beach Road, Naples, FL 34108. The telephone number for the Annual Meeting location is (239) 598-3300. The doors to the meeting room will open for admission at 9:00 a.m. (ET). Directions to the meeting location are posted on our website located atwww.thesimplygoodfoodscompany.com. Proof of stock ownership and some form of government-issued photo identification (such as a valid driver's license or passport) will be required for admission to the Annual Meeting.Only stockholders who own Simply Good Foods' common stock as of the close of business on December 4, 2017 (the "Record Date") will be entitled to attend and vote at the Annual Meeting. If you are a stockholder of record as of the Record Date and you plan to attend the Annual Meeting, please save your proxy card, as the case may be, and bring it to the Annual Meeting as your admission ticket. If you plan to attend the meeting but your shares are not registered in your name, you must bring evidence of stock ownership as of December 4, 2017, which you may obtain from your bank, stockbroker or other adviser, to be admitted to the meeting. No cameras, recording devices or large packages will be permitted in the meeting room. Under appropriate circumstances, we may provide assistance or a reasonable accommodation to attendees of the Annual Meeting who require assistance to gain access to the meeting or to receive communications made at the meeting. If you would like to request such assistance or accommodation, please contact us at (303) 633-2840 or at The Simply Good Foods Company, 1050 17th Street, Suite 1500, Denver, Colorado, 80265. Please note that we may not be able to accommodate all requests. Information About this Proxy Statement Why You Received this Proxy Statement. You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This Proxy Statement includes informationweall directors are required to provide to you under the rules of the Securities and Exchange Commission (the "SEC") and that is designed to assist you in voting your shares. Availability of Proxy Statement and Annual Report. This Proxy Statement and our Annual Reportelected for the fiscal year ended August 26, 2017 (the "Annual Report") is available to our stockholders electronically via the Internet at www.thesimplygoodfoodscompany.com. On December 21, 2017, we also began mailing this Proxy Statement and the Annual Report to our stockholders of record as of the Record Date. Stockholders can vote in personone-year terms. As a result, at the Annual Meeting or by proxy. There are three ways to vote by proxy:•By Telephone—Stockholders who received a proxy card by mail and are located in the United States can vote by telephone by calling the phone number, and following the instructions, on the proxy card;•By Internet—You can vote over the Internet atwww.proxyvote.com; or•By Mail—If you received your proxy materials by mail, you can vote by mail by signing, dating and mailing the enclosed proxy card. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. (ET) on January 30, 2018. We encourage you to submit your proxy as soon as possible (by telephone, Internet or by mail) even if you plan to attend the meeting in person. If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record as to how to vote your shares. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker's proxy card and bring it to the Annual Meeting in order to vote. Please note that if you hold your shares through a broker, your broker cannot vote your shares on the election of directors unless you have given your broker specific instructions as to how to vote. In order for your vote to be counted, please make sure that you submit your vote to your broker. If you vote by proxy, the individuals named on the proxy card (your "proxies") will vote your shares in the manner you indicate. You may specify whether your shares should be voted for or against all, any or none of the nominees for director and whether your shares should be voted for or against each of the other proposals. If you sign and return the proxy card without indicating your instructions, your shares will be voted as follows:•FOR the election of all three Class I nominees for director;•FOR the ratification of the appointment of Ernst & Young LLP ("Ernst & Young") as our independent registered public accounting firm for our 2018 fiscal year; and•For any other matter properly presented before the meeting, in the discretion of the proxies. You may revoke or change your proxy before the meeting for any reason by (1) if you are a registered stockholder (or if you hold your shares in "street name" and have a proper legal proxy fromyour broker), voting in person at the Annual Meeting, (2) submitting a later-dated proxy, either by telephone or online (your last vote before the meeting begins will be counted), or (3) sending a written revocation that is received before the Annual Meeting to the Corporate Secretary of The Simply Good Foods Company, c/o The Simply Good Foods Company, 1050 17th Street, Suite 1500, Denver, Colorado, 80265. Each share of our common stock is entitled to one vote. As of the Record Date, there were 70,582,573 shares of our common stock outstanding. A quorum is necessary to hold a valid meeting. A quorum will exist if stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting are present, in person or by proxy. Abstentions and broker "non-votes" are counted as present for purposes of determining whether a quorum exists. A broker "non-vote" occurs when a bank or broker holding shares for a beneficial owner does not voteseats on a proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Banks and brokers will have discretionary voting power for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our 2018 fiscal year (Proposal 2), but not for voting on the election of the Class I director nominees (Proposal 1). Required Votes for Action to be Taken Three Class I directors have been nominated for election to our Board of Directors at the Annual Meeting. Our Amended and Restated Bylaws (the "Bylaws") provide that directors shall be elected by a plurality of the votes of the shares present and entitled to vote and actually cast on the election of such directors. This means that the three Class I director nominees receiving the highest number of "FOR" votes cast will be elected. Abstentions and broker non-votes will have no effect on the outcome of theare up for election. For the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, the affirmative vote of the holders of shares of common stock having a majority in voting power of the votes cast by the holders of all of the shares of common stock present or represented at the Annual Meeting and voting on the matter is required in order to be approved. Abstentions will have no effect on this proposal. The following table summarizes the votes required for passage of each proposal and the effect of abstentions and uninstructed shares held by brokers.Brokers and custodians cannot vote uninstructed shares on your behalf in director elections. For your vote to be counted, you must submit your voting instruction form to your broker or custodian.ProposalVotes required for approvalAbstentionsBrokerUninstructed shares(Broker non-votes)1. Election of the three Class I director nomineesA plurality of the votes cast (the three nominees receiving the highest number of "FOR" votes cast will be elected)No impactNo impact2. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our 2018 fiscal yearMajority of shares castNo impactVoted in the broker's discretion Other Business to be Considered Our Board of Directors does not intend to present any business at the Annual Meeting other than the proposals described in this Proxy Statement and knows of no other matters that are likely to be brought before the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, your proxies will act on such matter in their discretion. In accordance with our Amended and Restated Certificate of Incorporation, our Board of Directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Except as otherwise provided by law and subject to the terms of two investorsthe investor rights agreementsagreement (the “Investor Rights Agreement”) entered into between Simply Good Foodsthe Company and Conyers Park Sponsor, LLC ("(“Conyers Park Sponsor"Sponsor”), and Simply Good Foods, Conyers Park Sponsor and Atkins Holdings LLC (the "Investor Rights Agreements"), as part of the Business Combination, and any other rights of any class or series of preferred stock that may be issued in the future, vacancies on our Board of Directors (including a vacancy created by an increase in the size of the Board of Directors)Board) may be filled only by the remaining directors. See "Certain“Certain Relationships and Related Person Transactions—Transactions — Investor Rights Agreements"Agreement” below for additional information on certain director nomination rights.directors are divided amongCorporate Governance Guidelines provide that a director shall not be eligible to stand for reelection if that director reaches their 78th birthday prior to the three classes as follows:

th birthday.•The Class I directors are Joseph E. Scalzo, Robert G. Montgomery and Arvin "Rick" Kash, with terms expiring atnext director election. A director, however, may serve out the Annual Meeting;•The Class II directors are Clayton C. Daley, Jr., James E. Healey and Nomi P. Ghez, with terms expiring atcurrent term following the annual meeting of stockholders to be held in 2019; and•The Class III directors are James M. Kilts, David J. West, Brian K. Ratzan and Richard T. Laube, with terms expiring at the annual meeting of stockholders to be held in 2020. NASDAQ that a majority of our Board of Directors be independent. An "independent director"“independent director” is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which in the opinion of our Board, of Directors, would interfere with the director'sdirector’s exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors conducts an annual assessment of the independence of each member of our Board, of Directors, taking into consideration all relationships between usthe Company and/or our officers, on the one hand, and each director on the other, including the director'sdirector’s commercial, economic, charitable and family relationships, and such other criteria as our Board of Directors may determine from time to time. of Directors has determined that Mses. Ghez and Goolsby and Messrs. Kilts, Daley, Montgomery, Ratzan, Ritterbush, Schena, West Ratzan, Daley, Healey, Montgomery, Kash and Laube and Ms. GhezWhite are "independent directors"“independent directors” as defined in the NASDAQNasdaq listing standards and applicable SEC rules. In making its independence determinations, the Board of Directors considered whether any of the directors was or is a party to certain types of relationships and transactions. See "—“— Review of Related Person Transactions"Transactions” below.wasand Geoff E. Tanner were each determined not to not be an independent director because heMr. Scalzo currently serves as theour Executive Vice Chairman and is our former President and Chief Executive Officer and Mr. Tanner is our current President of the Company. of Directors does not have a formal policy regardingrequiring the separation of the roles of Chief Executive Officer and ChairmanChairperson of the Board of Directors.Board. The Board of Directors believes it is in our best interests to make that determination based on circumstances from time toof Directors chairs the meetings of our Board of Directors and meetings of our stockholders, with input from the Executive Vice Chairman and the Chief Executive Officer. The Executive Vice Chairman works with the Chief ExecutiveDirectors of theour growth strategy of Simply Good Foods and works with the Chief Executive Officer and the Chief Financial Officer in coordinating our activities with key external stakeholders and parties. These activities include corporate governance matters, investor relations, financing, and mergers and acquisitions. of Directors believes that this structure, combined with our corporate governance policies and processes, creates an appropriate balance between strong and consistent leadership and independent oversight of our business. Our Board of Directors believes that our current leadership structure and the composition of our Board of Directors protect stockholder interests and provide adequate independent risk management and other oversight of our business, while also providing outstanding leadership and direction for our Board of Directors and management. More than a majority of our current directors are "independent"“independent” under NASDAQNasdaq standards, as more fully described above.of Directors, and each Board committee (of whichthe Audit, Compensation, Corporate Responsibility and Sustainability and Nominating and Corporate Governance Committees are all are comprised of independent directors),directors. The full Board and each of the Board’s committees meet in executive sessions, without management present, during each regularly scheduled Board or committee meeting and are very active in the oversight of the Company. Each independent director has the ability tocan add items to the agenda for Board meetings or raise subjects for discussion that are not on the agenda for that meeting. In addition, our Board of Directors and each Board committee has complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate.Committeesof Directors and each Board committee intend to conductconducts self-evaluations to assess their respective performancesperformance and consider potential areas of improvement. Because the Company is newly formed and the Board of Directors has served less than a full year, the Board of Directors will not conduct an evaluation until the end of the 2018 fiscal year. The assessments will focus on the effectiveness of the Board of Directors and each Board committee, assessed against their respective responsibilities as set forth in the Board'sBoard’s Governance Guidelines and each committee charter. Directors will consider matters such as fulfillment of the board'sBoard’s and their individual primary responsibilities, effectiveness of discussion and debate at meetings, the quality and timeliness of Board of Directors and Board committee materials and presentations, the composition of the Board of Directors and each Board committee (including experience, skills and independence of members), and effectiveness of the Board of Directors'Board’s and each Board committee'scommittee’s processes. Responses will beare reviewed and shared with the Chairman of the Board and the entire Board for the Board’s evaluation and the chairs of Directors andthe respective Board committees and the committee members for the committees’ evaluations, and appropriate responsive actions considered as necessary.ininto which we propose to enter. The Audit Committee'sCommittee’s charter and our Related Party Transactions Policy detail the policies and procedures relating to transactions that may present actual, potential or perceived conflicts of interest and may raise questions as to whether such transactions are consistent with the best interest of Simply Good Foodsus and our stockholders. A summary of such policies and procedures is set forth below. Committee'sCommittee’s attention will be analyzed by the Audit Committee, in consultation with outside counsel or members of management, as appropriate, to determine whether the transaction or relationship does, in fact, constitute a related party transaction. At its meetings or in the interim as necessary, the Audit Committee will be provided with the details of each new, existing or proposed related party transaction, including the terms of the transaction, the business purpose of the transaction and the benefits to us and to the relevant related party.among other factors, the following factors to the extent relevant:Simply Good Foodsus and on the same basis as would apply if the transaction did not involve a related party;Simply Good Foodsus to enter into the transaction;so requested by the ChairmanChair of the Audit Committee, participate in some or all of the Audit Committee'sCommittee’s discussions of the transaction. Upon completion of its review of the transaction, the Audit Committee may determine to permit or to prohibit the transaction.of Directors in Risk Oversight Theof Directors hashave an active role, as a whole and also at the Board committee level, in overseeing management of the Company'sCompany’s risk. While the Board of Directors is ultimately responsible for overall risk oversight at our Company, our threefour Board committees assist the full Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. From time to time, the risk areas described below that are primarily assigned to a Board committee are discussed by the full Board.Company'sCompany’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the Company'sCompany’s exposure to risk is handled, and for monitoring the Company'sCompany’s major financial risk exposures and the steps the Company has taken to monitor and control such exposures. In connection with its risk assessment and management responsibilities, the Audit Committee oversees risks related to food safety, cybersecurity and other risks relevant to our computerized information system controls and security. As part of this responsibility, an annual risk assessment is conducted by management and presented to the Audit Committee for its review. The results of this assessment are then shared with the full Board and each of the other Board committees for those topics covered by the committee’s respective charter. In addition, the meeting materials for each regularly scheduled Board meeting include an update of management’s annual risk assessment, which is overseen by the Audit Committee. The Audit Committee also is charged with overseeing risks with respect to our Related Party TransactionTransactions Policy as noted above, and with any potential conflicts of interest with directors and director nominees.impacteffect on the Company.management development. evaluating changes to our corporate governance structures. of Directors our stockholders or other interested parties wish to contact any member of our Board, of Directors, they may write to the Board of Directors or to an individual director in care of the Corporate Secretary at The Simply Good Foods Company, 10501225 17th Street, Suite 1500,1000, Denver, Colorado 80265, or P.O. Box 44159, Denver, CO 80201;80202; or through our third partythird-party ethics and compliance reporting website at SimplyGoodFoods.Ethicspoint.com.SimplyGoodFoods.Ethicspoint.com. Relevant communications will be distributed to the Board, of Directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unrelated to the duties and responsibilities of the Board of Directors will not be forwarded, such as business solicitations or advertisements, junk mail, mass mailings and spam, new product suggestions, product complaints or inquiries, resumes and other forms of job inquiries, or surveys. In addition, material that is threatening, illegal or similarly unsuitable will be excluded. Any communication that is screened as described above will be made available to any director upon his or her request.Agreements,Agreement, the Nominating and Corporate Governance Committee, with the input of the Chief Executive Officer, is responsible for recommending nominees for Board membership to fill vacancies or newly created positions, and for recommending the persons to be nominated for election at the Annual Meeting. In connection with the selection and nomination process, the Nominating and Corporate Governance Committee reviews the desired experience, skills, diversity and other qualities to ensure appropriate Board composition, taking into accountconsidering the current Board members and the specific needs of the Company and the Board of Directors.Board. In connection with the process of nominating incumbent directors for re-election to the Board, the Nominating and Corporate Governance Committee also considers the director'sdirector’s tenure on and unique contributions to the Board of Directors.In considering whether to recommendThe Nominating and Corporate Governance Committee will request that any candidate to the Board of Directors,search firm that the Nominating and Corporate Governance Committee considers applicationsengages include candidates with diversity of gender, race, ethnicity and culture in its list of potential director candidates.ensuremaintain and grow a diverse and broad skill set that complements the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to the Company's business. The Nominating and Corporate Governance Committee has adopted nominating criteria guidelines that include understanding operations, marketing, finance or other aspects relevant to the success of a publicly traded company in today'stoday’s business environment, with broad experience in relevant disciplines. The Nominating and Corporate Governance Committee will alsomay consider certain factors related specifically to our business, including, but not limited to:Extensive consumer packagedconsumer-packaged goods/food products industries, particularly in branded food, nutrition and snacking, but principally in industries oriented to consumer products;ExperienceInternationalLeadershipHigh levelOur BoardIn the evaluation of Directors believes thatpotential new candidates, the backgroundsNominating and Corporate Governance Committee considers each candidate’s qualifications in light of the directors, considered as a group, should provide a significant compositethen-current mix of experience, knowledgeBoard attributes, including diversity. Continuing directors are evaluated by the Nominating and abilities that will allowCorporate Governance Committee in the same way, including the continuing director’s past contributions to the Board in such evaluation.Directorsbackground and personal experience should be applied in identifying or evaluating director candidates, to fulfill its responsibilities.help ensure the Board remains aware of and responsive to the needs and interests of our customers, stockholders, employees and other stakeholders, the Board believes it is important to identify qualified director candidates who would increase the gender, racial, ethnic and/or cultural diversity of the Board. Similarly, we believe a Board made up of highly qualified individuals from diverse backgrounds is important to the success of the business, in addition to promoting better corporate governance and performance and effective decision making. Accordingly, when evaluating the current directors and considering the nomination of new directors, the Nominating and Corporate Governance Committee makes an effort to ensure the composition of the Board reflects a broad diversity of experience, profession, expertise, skill, and background, including gender, racial, ethnic, and/or cultural diversity. Consistent with the Board’s goal of enhancing the Board’s diversity of experience, skills, and background, the Board appointed Ms. Goolsby and Mr. White to the Board in 2019, and the Board believes these directors have provided valuable experience and insight, along with additional diversity to the Board. The Board and the Nominating and Corporate Governance Committee are committed to ensuring the Board functions effectively and with appropriate diversity and expertise, including women and minorities. Accordingly, approximately 25% of our directors were women or minorities during fiscal year 2023. Nominees are not discriminated against on the basis of race, religion, national origin, disability or sexual orientation. Stockholders The Board and the Nominating and Corporate Governance Committee are committed to continue to seek female and minority candidates to join the Board. of Directors for nomination and also have the right under our Third Amended and Restated Bylaws (the “Bylaws”) to nominate directors.directors, which is why the Board believes it is appropriate not to have such a policy. Stockholders may recommend individuals to the Board of Directors for consideration as potential director candidates by submitting candidates'candidates’ names, appropriate biographical information (including age, business address and residence address, principal occupation or employment and relevant experience), the class or series and number of shares of capital stock of the Company which are directly or indirectly owned beneficially or of record by the candidate, the date such shares were acquired and the investment intent of such acquisition and any othertheour principal executive offices of the Company at:Corporate Secretaryc/o The Simply Good Foods Company1050 17th Street, Suite 1500Denver, Colorado, 80265 ![[MISSING IMAGE: ic_mail-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_mail-pn.jpg)

Corporate Secretary

c/o The Simply Good Foods Company

1225 17th Street, Suite 1000

Denver, Colorado 80202 of Directors will evaluate stockholder-recommendedstockholder recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the Board of Directors determines to nominate a stockholder-recommendedstockholder recommended candidate and recommends his or hertheir election to the Board, of Directors, then his or hertheir name will be included in the proxy statement for the next annual meeting of stockholders.the Companywe be given advance written notice of stockholder nominations for election to the Board of Directors.Board. Such nomination must contain the information required by our Bylaws with respect to the nominee and the stockholder. To be timely, a stockholder'sstockholder’s notice must be delivered to Simply Good Foods'our Corporate Secretary, in the case of an annual meeting, not earlier than the 120th day and no later than the 90th day prior to the first anniversary of the date of the preceding year'syear’s annual meeting. of Directors supports the development of the Company'sCompany’s executive talent, especially the Chief Executive Officer and the senior leaders of the Company, because continuity of strong leadership at all levels of the Company is part of the Board'sBoard’s mandate for delivering strong performance to stockholders. To further this goal, the executive talent development and succession planning process is overseen by the Nominating and Corporate Governance Committee pursuant to its charter. The Nominating and Corporate Governance Committee is charged with developing and recommending to the Board of Directors the approval of an executive officer succession plan. The Nominating and Corporate Governance Committee is also is responsible for implementing the succession plan by developing and evaluating potential candidates for executive positions, and periodically reviewing the succession plan. As this is the first year post-Business Combination, the Nominating and Corporate Governance Committee will be developing and formalizing the processes for implementing these responsibilities. However, prior to the Business Combination, our management has been actively involved with regularly identifying high potential executives for additional responsibilities, new positions, promotions or similar assignments that expose them to diverse operations within the Company, and expects to continue this practice. These individuals are often positioned to interact more frequently with the Board of Directors so that directors may gain familiarity with these executives. ![[MISSING IMAGE: ic_cross-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cross-bw.jpg)

pledging any of our securities as collateral for a loan ![[MISSING IMAGE: ic_cross-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cross-bw.jpg)

buying or selling put or call positions or other derivative positions in our securities ![[MISSING IMAGE: ic_cross-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cross-bw.jpg)

holding our securities in a margin account ![[MISSING IMAGE: ic_cross-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cross-bw.jpg)

entering into hedging or monetization transactions or similar arrangements with respect to our securities ![[MISSING IMAGE: ic_cross-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cross-bw.jpg)

engaging in short sales EthicsEthicsConduct that applies to all of our directors, executive officers and employees.employees and a code of ethics for our senior financial officers. We refer to these documents together as our “Code of Conduct.” Our Code of EthicsConduct is"Investors"“Investors” link followed by the "Corporate Governance"“Corporate Governance” link. Any amendments to or waivers of our Code of EthicsConduct relating to our directors or executive officers that isare required to be disclosed also will be posted on our website.We have designated our General Counsel as Our compliance officer who oversees our ethics and compliance program and provides regular reports to each of the Audit Committee and the Nominating and Corporate Governance Committee on the program'sprogram’s effectiveness and the status of any reports or complaints made under the Code of EthicsConduct reporting procedures.Committee Chartersadopting the Rule 10D-1 Incentive Compensation Recovery Policy, the Board amended and SEC Filings We believe that the charters adoptedrestated its existing clawback policy to apply to certain incentive compensation not otherwise covered by the Audit,Rule 10D-1 Incentive Compensation and Nominating and Corporate Governance Committees complyRecovery Policy (the “General Clawback Policy”).applicable corporate governance rules of NASDAQ. These charters are availableus that gives rise to a material adverse effect on our website atwww.thesimplyfoodgoodscompany.comfinancial condition or reputation, and can be accessedsuch act or omission (i) constituted willful, knowing or intentional violation of any of our rules or any applicable legal or regulatory requirements, or (ii) constituted fraud or other illegal conduct, then the Board shall determine whether we should seek to recover from that executive officer or employee up to 100% (as determined by clickingthe Board in its sole discretion as appropriate based on the "Investors" link followedconduct involved) of the incentive compensation received by that executive officer or employee during the "Corporate Governance" link.Tablethree completed fiscal years immediately preceding the date the Board becomes aware of Contents Following is a descriptionsuch material adverse effect. The General Clawback Policy includes language to prohibit the recovery of Simply Good Foods' 2017 compensation program for non-employee directors. Mr. Joseph Scalzo, as our Chief Executive Officer, does not receive separatethe same incentive compensation for his service as director. the same events under both policies. ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

of Directors, as appropriate. Annual Board

Service Cash Retainer $ 85,000 Restricted Stock Units(1) $ 115,000 Board and

Committee Chair

Cash Retainer Chair of the Board $ 90,000 Audit Committee $ 10,000 Compensation Committee $ 10,000 Corporate Responsibility and Sustainability $ 10,000 Nominating and Corporate Governance Committee $ 10,000 of Atkins who served in fiscal 2017 prior to the Business Combination, and for the non-employee directors of the Company serving after the Business Combination through the fiscal year ending on August 26, 2017.2023. In addition to the amounts shown below, Atkins and the Company, respectively,we also reimbursed allreimburse directors for travel expenses and other out-of-pocket costs incurred in connection with their attendance at meetings. Messrs. Joseph Scalzo and Geoff Tanner do not receive separate compensation for their service as director. Name

or Paid in Cash

($)

($)(1)

($) James M. Kilts 175,000.00 114,997.73 289,997.73 Clayton C. Daley, Jr 95,000.00 114,997.73 209,997.73 Nomi P. Ghez 95,000.00 114,997.73 209,997.73 Michelle P. Goolsby 95,000.00 114,997.73 209,997.73 Robert G. Montgomery 85,000.00 114,997.73 199,997.73 Brian K. Ratzan 85,000.00 114,997.73 199,997.73 David W. Ritterbush 85,000.00 114,997.73 199,997.73 Joseph J. Schena 95,000.00 114,997.73 209,997.73 David J. West 85,000.00 114,997.73 199,997.73 James D. White 85,000.00 114,997.73 199,997.73 Fees earned or

paid in cash

($) Stock/option

awards

($) All other

compensation

($) Total

($) — — — — 100,000 — — 100,000 — — — — 50,000 — — 50,000 50,000 — — 50,000 50,000 — — 50,000 — — — — 100,000 — — 100,000 8,242 — — 8,242 11,676 — — 11,676 9,615 — — 9,615 9,272 — — 9,272 8,929 — — 8,929 8,242 — — 8,242 8,242 — — 8,242 8,242 — — 8,242 8,242 — — 8,242

TABLE OF CONTENTS(1)Atkins directors received their full feestwo half year payments priorNote 13 to the Business Combination.(2)Company's currentfollowing table presents the number of outstanding RSUs held by each director compensation program provides for directors to receive annual cash compensationas of $60,000 paid quarterly, and Restricted Stock Units valued at $90,000. The Board chair, Vice Chair and ChairsAugust 26, 2023. None of the committees receive additional annual compensation. Mr. Kilts as Chair is entitled to receive an additional fee of $25,000, but he has waived his fee. Mr. West receives $25,000 as Vice Chair. Mr. Healey receives $10,000 as Chair of the Audit Committee. Mr. Daley receives $7,500 as Chair of the Compensation Committee, and Ms. Ghez receives $5,000 as Chair of the Nominating and Governance Committee. The directors received a portion of their first quarter fees prorated from July 7, 2017 to August 26, 2017 (fiscal year end).hold stock options. Director

Subject to Outstanding

RSUs as of

August 26, 2023(1) James M. Kilts 3,889 David J. West 3,889 Clayton C. Daley, Jr 3,889 Nomi P. Ghez 3,889 Michelle P. Goolsby 3,889 Robert G. Montgomery 3,889 Brian K. Ratzan 3,889 David W. Ritterbush 3,889 Joseph J. Schena 3,889 James D. White 3,889

(1)No equity was granted to the directors in fiscal year 2017. Non-employee directors were granted 7,500 restricted stock units valued at $90,000 on September 6, 2017, which is fiscal 2018. The RSUs will vest in full on the anniversaryone year after grant. ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

grant, provided the director's service has not terminated.BoardDirector Stock Ownership Guidelines Our non-employee directors are required to own common stock equal to four times such director's annual retainer. Directors are expected to satisfy these guidelines within five years of becoming a director and may not sell any common stock until they are in compliance with such guidelines.MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS of Directors has established certain standing committees to assist in the performance of its various functions. All Board committee members are appointed by our Board of Directors upon recommendation of the Nominating and Corporate Governance Committee. of Directors has affirmatively determined, upon recommendation of the Nominating and Corporate Governance Committee, that all of the members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent as defined under the NASDAQNasdaq listing standards. The Board of Directors also has determined that all members of the Audit Committee meet the independence requirements contemplated by the NASDAQNasdaq listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), and, in determining the independence of all members of our Compensation Committee, the Board of Directors took into account the additional independence considerations required by the NASDAQNasdaq listing rules and Rule 10C-1 of the Exchange Act relating to Compensation Committee service. of Directors typically meets on a quarterly basis and holds special meetings as necessary. In 2017,fiscal year 2023, our Board of Directors met threefive times. Directors are required to regularly attend Board meetings and meetings of the committees on which they serve, unless unforeseen circumstances prevent them from doing so. In 2017,fiscal year 2023, all directors attended at least 75% of the total number of meetings of the Board of Directors(held during the period for which they have been a director) and the total number of meetings held by all committees of the Board on which they served with each director attending 100% of(during the Board of Directors and Board committee meetings during 2017.periods that they served). While we do not have a formal policy requiring our directors to attend stockholder meetings, our directors are invited and encouraged to attend all meetings of stockholders. All of our directors at the time attended the 2023 Annual Meeting of Stockholders.standing committees of our Board of Directors and indicates who currently serves on those committees. DirectorAuditCompensationNominating andCorporateGovernanceJames M. Kilts ——X David J. West —Compensation Committee — Corporate

Responsibility and

Sustainability

Committee— Nominating and

Corporate

Governance

Committee Clayton C. Daley, Jr. Jr (Chair) XMichelle P. Goolsby (Chair) X*———X James E. Healey![]()

X*David J. West — —Arvin Kash——XRichard T. LaubeX—— —James M. Kilts X— BrainNomi P. Ghez Robert G. Montgomery David W. Ritterbush Michelle P. Goolsby Michelle P. Goolsby Brian K. Ratzan — X — James D. White

* Committee Chair ![]()

Audit Committee Financial ExpertJames D. White standing Board committees are describedsummarized below. Each of the Board committees operates under a written charter; has authority to retain independent legal, accounting or other advisors, at our expense; makes regular reports to the Board of Directors;Board; and reviews its own performance annually. Audit Committee. The Audit Committee is responsible for, among other matters: (1) performing the Board's oversight responsibilities as they relate to the Company's accounting policies and internal controls, financial reporting practices, legal and regulatory compliance and the audit of the Company's financial statements; (2) maintaining Audit Committee The Audit Committee also evaluates, at least annually, the qualifications, performance and independence of our independent auditors, including an evaluation of the lead audit partner. The Board has determined that each member of the Audit Committee qualifies as an independent director according to Nasdaq rules and the rules and regulations of the SEC with respect to audit committee membership, and that Mr. Schena qualifies as an “audit committee financial expert,” as such term is defined in Item 401(d)(5)(ii) of Regulation S-K. Compensation Committee The Compensation Committee has delegated to a sub-committee of Messrs. Daley, Montgomery and White (the “Compensation Sub-Committee”) the authority to grant equity awards to executive officers. The Compensation Committee reviews and considers our Chief Executive Officer’s recommendations with respect to compensation decisions for our named executive officers other than himself. The Compensation Committee believes it is valuable to consider the recommendations of our Chief Executive Officer with respect to these matters because, given his knowledge of our operations, industry and the day-to-day responsibilities of our executive officers, he is in a unique position to provide the Compensation Committee perspective into the performance of our executive officers in light of our business at a given point in time. The Board (without the participation of our Chief Executive Officer) and Compensation Committee make all compensation decisions regarding our Chief Executive Officer. The Board has determined that each member of the Compensation Committee qualifies as an independent director according to Nasdaq rules and the rules and regulations of the SEC with respect to compensation committee membership. Corporate Responsibility and Sustainability Committee The Corporate Responsibility and Sustainability Committee was established in July 2021 to assist the Board in discharging its oversight responsibility related to ESG matters (but excluding corporate structure governance) and to provide guidance to management on these matters. ESG matters include climate change effects, energy and natural resources conservation, environmental and supply chain sustainability, human rights, employee health, safety and well-being, human capital resources, diversity, equity and inclusion, public policy engagement, political contributions, corporate charitable and philanthropic activities and other ESG matters that are relevant and material to the Company. The Board has determined that each member of the Corporate Responsibility and Sustainability Committee qualifies as an independent director according to Nasdaq rules. Nominating and Corporate Governance Committee The Board has determined that each member of the Nominating and Corporate Governance Committee qualifies as an independent director according to Nasdaq rules. The processes and procedures followed by the Nominating and Corporate Governance Committee in identifying and evaluating director candidates are described above under the heading “Board of Directors and Governance — Process for Recommending or Nominating Potential Director Candidates.” ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

![[MISSING IMAGE: ic_proposal-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_proposal-pn.jpg)

1 ![[MISSING IMAGE: ic_righ-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_righ-pn.jpg)

Board Diversity Matrix (As of December 7, 2023) Total Number of Directors:

12 Female Male Non-Binary Did Not

Disclose

Gender Part I: Gender Identity Directors 2 10 — — Part II: Demographic Background African American or Black — 1 — — Alaskan Native or Native American — — — — Asian — — — — Hispanic or Latinx — — — — Native Hawaiian or Pacific Islander — — — — White 2 9 — — Two or More Races or Ethnicities — — — — LGBTQ+ — Did Not Disclose Demographic Background — ![[MISSING IMAGE: bc_finance-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/bc_finance-pn.jpg)

Company's financial management;election and (3) preparingqualification of their successor, or until such director’s earlier death, disqualification, resignation or removal.report to be included in the Company's annual proxy statement. Our Audit Committee consists of Messrs. Healey, Daley and Laube, with Mr. Healey serving as the chairnominees named below. Each of the committee. The Board of Directors has determined that eachnominees listed below is currently a member of the Audit Committee qualifies as an independent director according to the rules and regulations of theSEC with respect to audit committee membership, and that Mr. Healey qualifies as an "audit committee financial expert," as such term is defined in Item 401(h) of Regulation S-K. The Audit Committee met twice in 2017. Compensation Committee. The Compensation Committee is responsible for, among other matters: (1) reviewing key employee compensation goals, policies, plans and programs; (2) reviewing and approving the compensation of our directors, chief executive officer and other executive officers; (3) reviewing and approving employment agreements and other similar arrangements between us andBoard, has been recommended by our executive officers; and (4) administering our stock plans and other incentive compensation plans. Our Compensation Committee consists of Messrs. Daley, Ratzan and Montgomery, with Mr. Daley serving as the chair of the committee. The Compensation Committee met seven times in 2017. Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee, is responsible for, among other matters: (1) identifying individuals qualifiedsubject to become members of our Board of Directors, consistent with criteria approvedthe Investor Rights Agreement, and nominated by our Board, and has agreed to stand for re-election. There are no family relationships among our directors, or between our directors and executive officers. A plurality of Directors; (2) overseeingvotes cast is necessary for the election of a director. There is no cumulative voting in the election of directors. Ages are as of the date of the Annual Meeting. REASONS FOR NOMINATION

We believe Ms. Ghez’s consumer financial analyst background, coupled with extensive financial and investment experience as described in detail above, make her well qualified to serve as a director. James M. Kilts Brian K. Ratzan David W. Ritterbush Committee(s): Audit Geoff E. Tanner ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

Name Age Position Geoff E. Tanner 50 President and Chief Executive Officer and Director Shaun P. Mara 59 Chief Financial Officer Stuart E. Heflin, Jr. 44 Senior Vice President, General Manager Quest marketing Ryan Thomas 45 Senior Vice President, General Manager Atkins marketing Timothy R. Kraft 44 Chief Legal Officer and Corporate Secretary Susan K. Hunsberger 61 Senior Vice President and Chief Human Resources Officer Timothy A. Matthews 44 Vice President, Controller and Chief Accounting Officer Boardsenior officers who are “named executive officers” for fiscal year 2023 but are no longer executive officers as defined under Securities and Exchange Commission rules, including their ages, as of Directorsthe date of the Annual Meeting: Name Age Position Jill Short Clark 55 Chief Customer Officer Linda M. Zink 59 Chief Growth Officer Jill Short Clark ![[MISSING IMAGE: tm2123483d2-bc_h1barpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/tm2123483d2-bc_h1barpn.jpg)

dischargeprovide our stockholders with a clear understanding of our compensation philosophy and objectives, compensation-setting process, and the Board's dutiescompensation of our named executive officers (“NEOs”) for fiscal year 2023. Our NEOs include our president and responsibilities properlychief executive officer, our former president and efficiently; (3) identifying best practiceschief executive officer, our chief financial officer, our former chief financial officer and recommending corporate governance principles;our three most highly compensated executive officers for fiscal year 2023 other than our chief executive officer and (4) developingchief financial officer. For fiscal year 2023, our NEOs were: GEOFF E.

TANNER JOSEPH E.

SCALZO SHAUN P.

MARA JILL M.

SHORT LINDA M.

ZINK TIMOTHY R.

KRAFT TODD E.

CUNFER* President and Chief Executive Officer Exec Vice Chair and Former President and Chief Executive Officer Chief Financial Officer Chief Customer Officer Chief Growth Officer Chief Legal Officer and Corporate Secretary Former Chief Financial Officer recommendingother executive officers is designed to meet the following primary objectives: Boardperformance and other factors that directly and indirectly influence stockholder value. The Compensation Committee demonstrated its pay-for-performance philosophy and alignment of Directorsexecutive and stockholder interests in setting executive compensation by continuing to weight compensation toward performance-based pay.![[MISSING IMAGE: pc_ceo-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/pc_ceo-pn.jpg)

![[MISSING IMAGE: ic_financia-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_financia-pn.jpg)

Strong Results Despite Significant Inflationary Pressures ![[MISSING IMAGE: ic_cash-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_cash-pn.jpg)

Strong Cash Generation Our asset-light, outsourced manufacturing business model continues to be a competitive advantage. In fiscal year 2023, we generated steady cash flow from operations of $171.1 million. During the year, we paid down $121.5 million of our term loan debt, and at the end of fiscal year 2023 the outstanding principal balance was $285 million, we had cash and cash equivalents of $87.7 million, and our trailing 12-month Net Debt to Adjusted EBITDA ratio was 0.8x*. ![[MISSING IMAGE: ic_ecomer-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_ecomer-pn.jpg)

Increasing Market Performance in Attractive Nutritional Snacking Category Our total Simply Good Foods market performance within the total nutritional snacking category, in the combined measured and unmeasured channels, increased 13%. This is based on IRI Multi-outlet plus Convenience Stores (IRI-MULO+C store) retail takeaway data for measured channels and our internal data for unmeasured channels. Quest and Atkins continue to be leaders in their respective subsegments of active nutrition and weight management with top tier performance versus competitor brands. Specifically, Quest fiscal year retail takeaway in measured and unmeasured channels grew about 24% compared to fiscal year 2022. Atkins total retail takeaway in measured and unmeasured channels was up about 1% in fiscal year 2023 despite contraction in the weight loss subsegment of the category. We believe the long-term growth outlook for the nutritional snacking category is strong. We also believe current low household penetration coupled with consumer interest in snacking and wellness, provide tailwinds for future growth. ![[MISSING IMAGE: ic_supply-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_supply-pn.jpg)

Supply Chain Excellence Our supply chain team performed well and customer service levels improved during fiscal year 2023. Our team’s collaborative work with suppliers, contract manufacturers and distributors enabled us to service our retail and e-commerce customers at expected levels. ![[MISSING IMAGE: ic_snacks-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/ic_snacks-pn.jpg)

Robust Innovation A portion of our sales is driven by new products, and we believe innovation will continue to be an important component of our business. In fiscal year 2023, we continued to build a robust pipeline of innovation across both of our brands. We believe these new products position us for continued market share gains in fiscal year 2024 and beyond. We believe the diversification of our business across brands, product forms and retail channels provides us with multiple ways to win in the marketplace. ![[MISSING IMAGE: pc_sayonpay-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-124249/pc_sayonpay-pn.jpg)

At our annual meeting of stockholders in January 2023, we held our annual advisory vote to approve the compensation of our named executive officers. The fiscal year 2022 compensation of our named executive officers reported in our 2023 proxy statement was approved by 99.3% of the votes cast at the 2023 annual meeting of stockholders. Our Compensation Committee believes this affirms our stockholders’ support of our approach to executive compensation, and, as a result, the Compensation Committee did not make any significant changes to our executive compensation program for fiscal year 2023. Things We Do: What We Don’t Do: B&G Foods J&J Snack Foods Tootsie Roll Industries BellRing Brands John B. Sanfilippo & Son USANA Health Sciences Central Garden & Pet Company Lancaster Colony Utz Brands, Inc. Edgewell Personal Care Company Sovos Brands, Inc. Hostess Brands The Boston Beer Company Inter Parfums, Inc. The Hain Celestial Group Fixed Variable Base Salary Benefits Annual Cash Incentive Equity Awards Design & Purpose To attract and retain executives by offering fixed compensation that is competitive with market opportunities and that recognizes each executive’s position, role, responsibility and experience. To provide attractive benefits that promote employee (and potentially family) health and wellness. Benefits are provided at a level that is the same or similar to all employees. To motivate and reward the achievement of our annual performance, based on the attainment of pre-defined financial performance objectives. To align executives’ interests with the interests of stockholders through equity-based compensation with performance-based and time-based vesting periods, and to promote the long-term retention of our executives and other key management personnel. corporate governance guidelinesthe executive’s responsibilities, individual contributions, prior experience and principlessustained performance. Named Executive Officer Base Salary

at End of

Fiscal Year 2022 Base Salary

at End of

Fiscal Year 2023 Increase Over

Fiscal Year 2022